Bitcoin Weekend Recap: $BTC Reclaims $57K As Hodlers, Maxis Help Drive Positive Sentiment

KEY POINTS

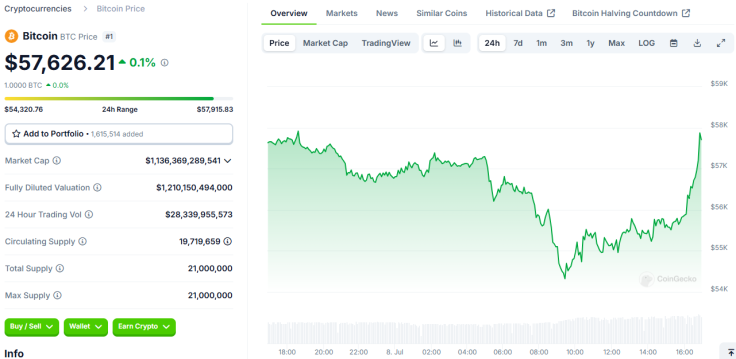

- $BTC was trading at $54,000 Sunday night before starting Monday above $57,000

- Germany's continuing sell-off has strained sentiment among small Bitcoin holders

- Hodlers such as Metaplanet and El Salvador have been buying the dip

- Some analysts are positive that the recent fears surrounding $BTC won't 'slay the bull'

Bitcoin has bounced back above $57,000 after a wild ride down the road in the past week. It was a difficult climb for the world's largest cryptocurrency by market value over the weekend, but its steady struggle to the $57,000 mark has raised some hopes in the largely frustrated Bitcoin community.

Wild weekend – shedding $3K to reclaim $3K

The digital currency was down to $54,000 Sunday night before reclaiming $57,000 early Monday, according to CoinGecko data. It was already above $56,000 Saturday before shrinking below $55,000 and held at around 54,000 Sunday. $BTC is still down by over 8% in the past week and declined by more than $16% in the past month.

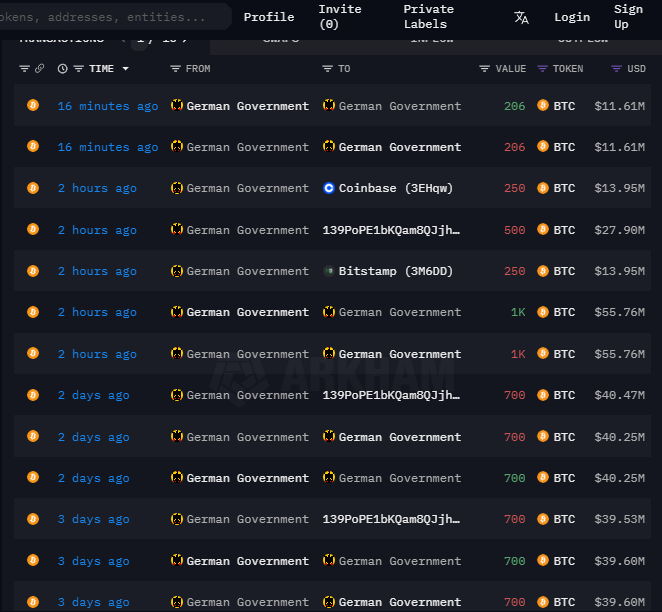

German government dump pressures sentiment

The German government's continuing sell-off of its massive $BTC stash has been pressuring the community market, and this is apparent due to the bearish sentiment among many smaller holders.

Data from blockchain analytics firm Arkham Intelligence showed that the German government continues to sell its Bitcoins, including 2,000 $BTC dumped early Monday.

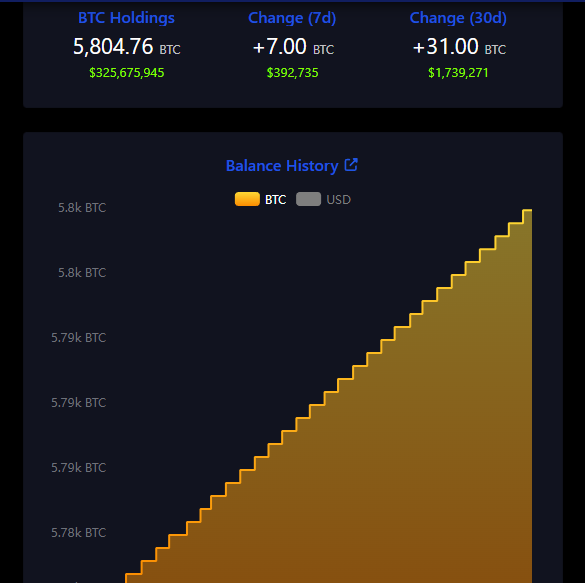

HODLers buy the dip

Despite the significant spike in FUD (fear, uncertainty and doubt) among small holders of the world's first decentralized cryptocurrency, the larger holders have been hodling – a term the crypto community refers to when holders refuse to sell their digital assets even with slumping prices and negative market sentiment.

Among the prominent hodlers in the market is El Salvador. Known as "Bitcoin country," El Salvador has stayed true to its President Nayib Bukele's promise that the country will purchase one $BTC daily. Based on its Bitcoin Office website, it has been snapping up the coin daily – even when prices were down. The Central American nation now has 5,804.76 Bitcoins.

Japanese tech firm Metaplanet also bought the dip. Adding 42.47 $BTC to its growing stash Sunday, it now holds over 203 Bitcoins.

*Metaplanet purchases additional 42.47 $BTC* pic.twitter.com/dPotWszW1Y

— Metaplanet Inc. (@Metaplanet_JP) July 8, 2024

Bitcoin maxis attempt to hold the community together

Bitcoin maximalists, holders of the digital currency who are very vocal about their sometimes "extreme" belief in $BTC's potential to overthrow gold in the future, have been hard at work in keeping the sentiment balance.

Former Blockstream executive Samson Mow reminded Bitcoiners that anyone holding the token can sell their stash, so holders should "stop fixating" themselves on MtGox, the collapsed crypto exchange that will start repaying billions worth of $BTC to its customers. "The fact is that Bitcoin supply is constrained, constantly decreasing, and demand is increasing. You should be panicking about not having stacked hard enough."

I don’t know who needs to hear this, but millions of @BTC can be sold at anytime.

— Samson Mow (@Excellion) July 7, 2024

Anyone that holds #Bitcoin can sell it. AT ANY TIME.

Stop fixating on Gox coins. First, it’s a drop in the bucket. Second, those coins are being distributed, not necessarily sold.

The fact is…

MicroStrategy founder and executive chairman Michael Saylor said Bitcoin "is engineered to keep winning," alongside a Creative Planning chart that showed $BTC still led other assets – by a staggering margin – in terms of cumulative returns since 2011.

#Bitcoin is engineered to keep winning. pic.twitter.com/6wevPntnc6

— Michael Saylor⚡️ (@saylor) July 6, 2024

Analysts weigh in on the future

Prominent Bitcoin analyst James Check said he is still generally optimistic that the sell-off from the German government and MtGox repayments "would be unlikely to slay the bull." However, Bitcoiners may also see the coin slumping to $52,000 at worst.

Shorts are being squeezed as we speak, and price is pushing back into the range.

— Jelle (@CryptoJelleNL) July 8, 2024

Reclaim $60,000 -- and it looks much, much better.#Bitcoin https://t.co/MJzJIbvvYO pic.twitter.com/VWQTNrX7E3

Crypto investor Jelle noted that $BTC prices are "pushing back into the range" at this point, and once the asset reclaims $60,000, charts should look much better.

© Copyright IBTimes 2025. All rights reserved.